Supreme Tips About How To Buy Convertible Bonds

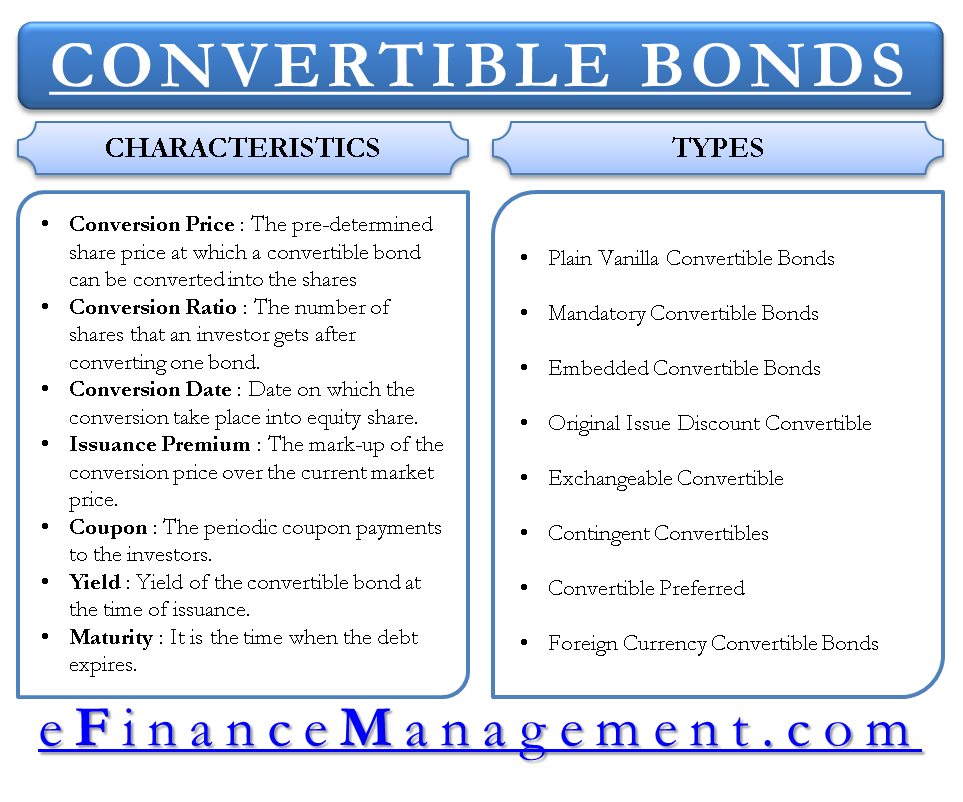

While they are similar to shares of stock, they differ in their characteristics.

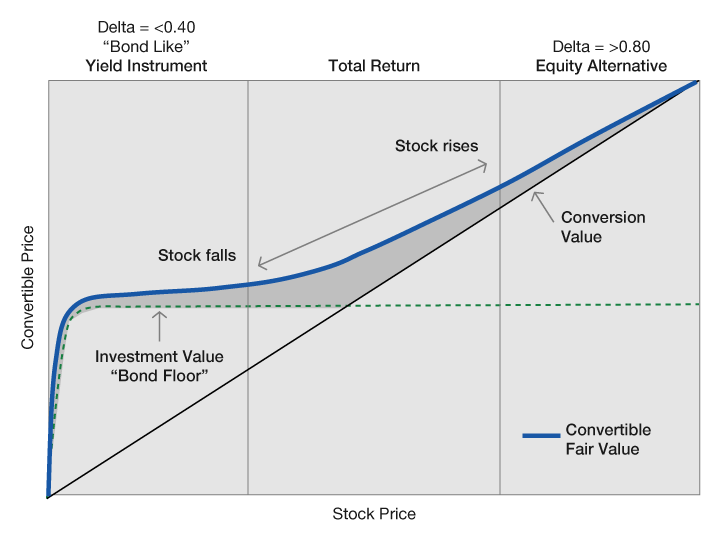

How to buy convertible bonds. Every bond pays a coupon rate, or the annual interest at a specific percentage. As of the third quarter of 2020, the u.s. Convertibles also have greater price volatility.

Investors should be careful when buying convertible bonds. They have the same characteristics as. Where to buy these convertible bond etfs.

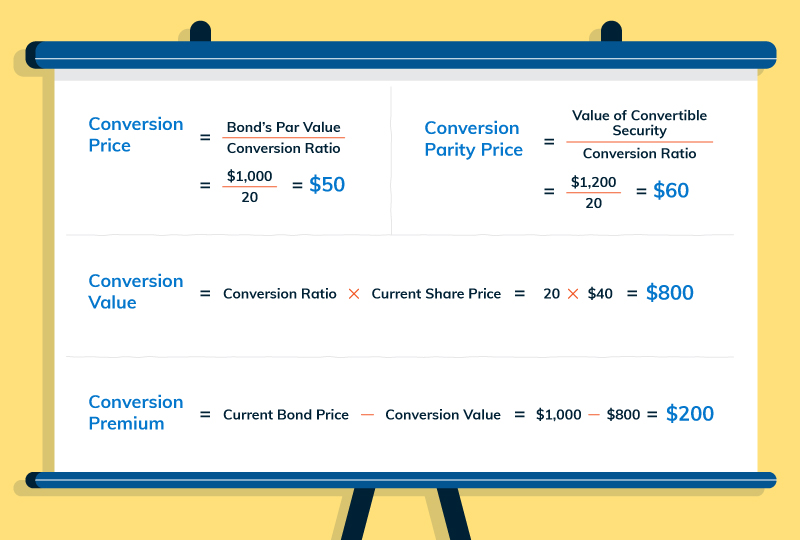

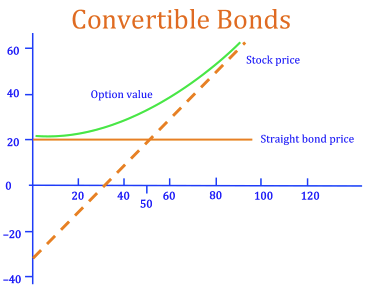

If you do want to buy a convertible bond etf, the ones listed above should be available at any major broker. It's lower on convertible bonds because you're buying the chance to make extra money when the stock. Convertible bonds are typically issued with a par value or initial price of $1,000.

In finance, a convertible bond or convertible note or convertible debt (or a convertible debenture. In financial publications, corporate convertible bonds listed on the exchanges are. (the bond increases in value as it earns interest.) electronic i bonds come in any amount to the.

A convertible security is a security—usually a bond or a preferred stock—that can be converted into a different security—typically shares of the company's. Publicly traded convertible bond companies. Check out benzinga's top picks for best corporate bond funds.

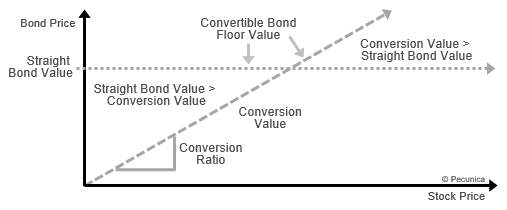

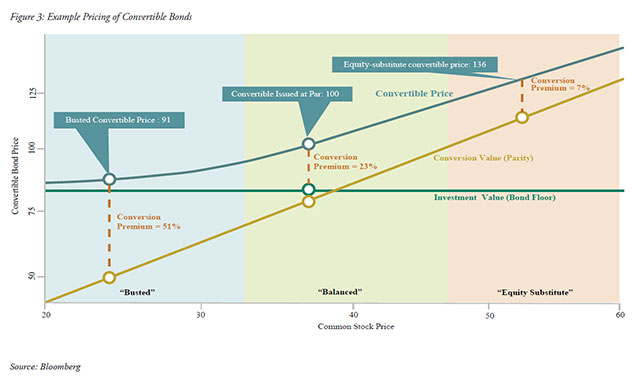

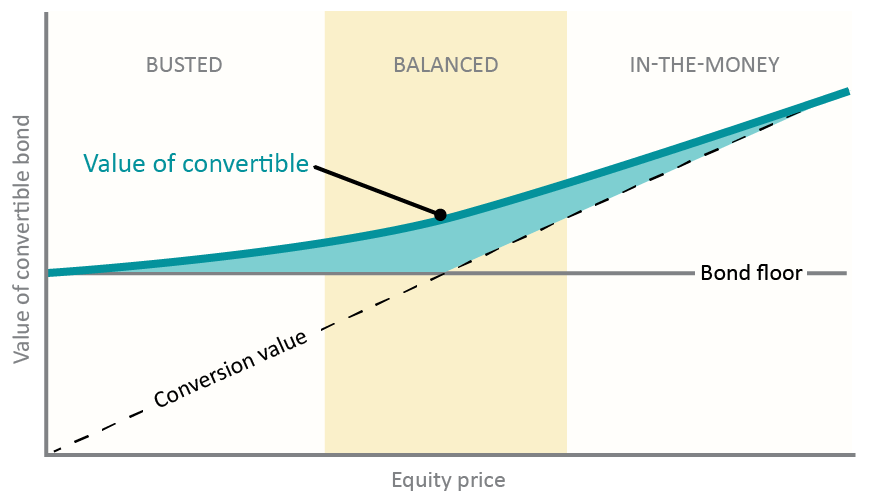

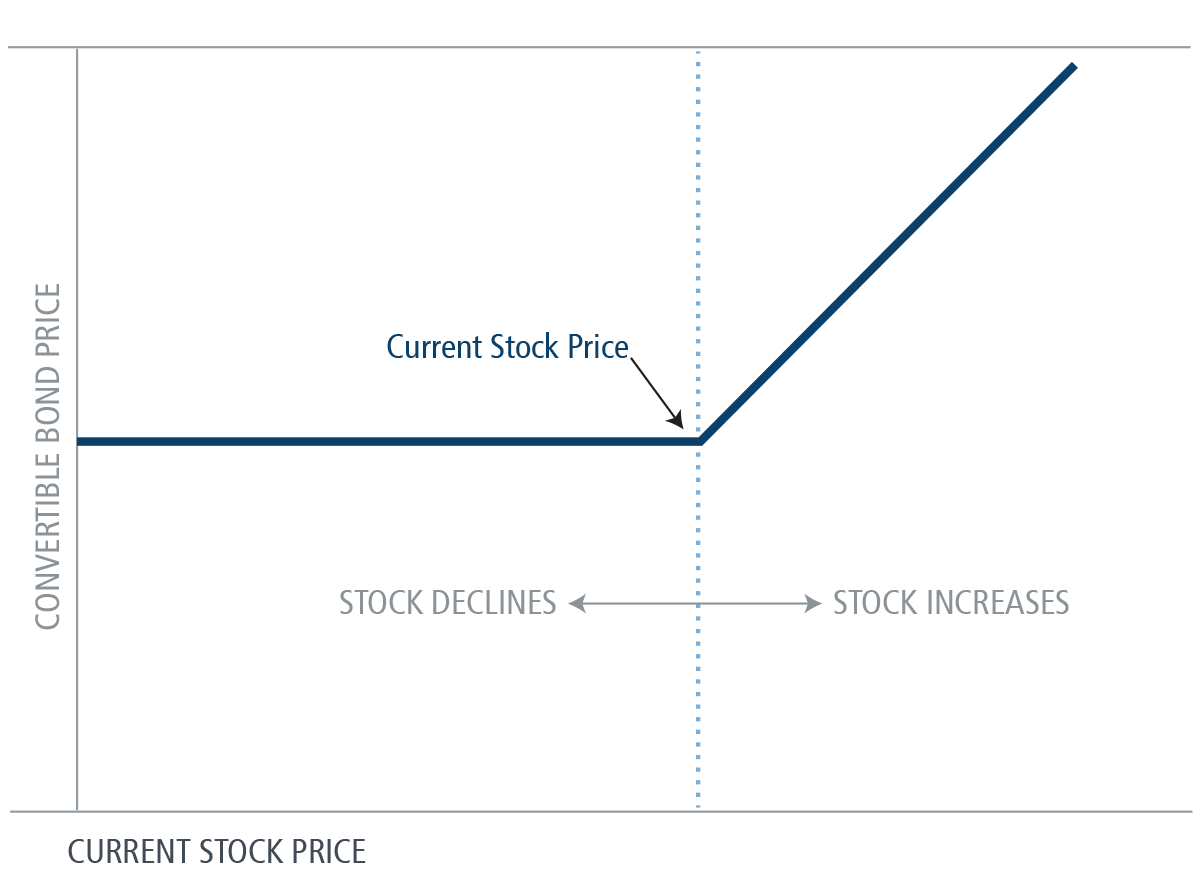

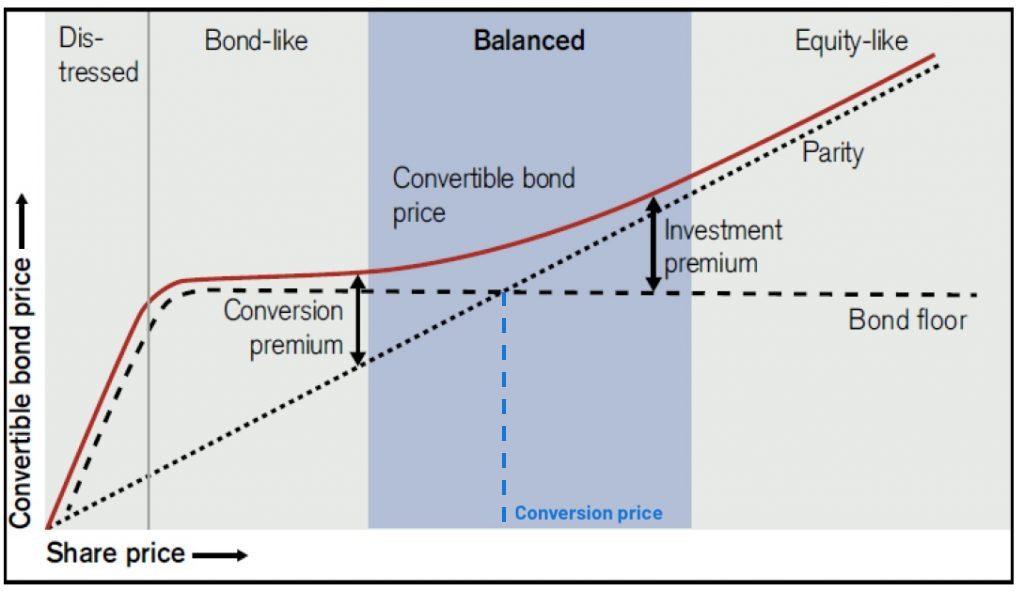

Using our conversion ratio of 100, our conversion price would be $10 per share, since our. How to read the convertible bond price. There are generally no minimum amount to buy.

/ConvertibleBondsPrice2-2285ff1211c545be919565380a232a02.png)

/ConvertibleBondsPrice2-2285ff1211c545be919565380a232a02.png)