Have A Info About How To Settle With American Express

Pledge to make a donation to charity for every invoice settled on time.

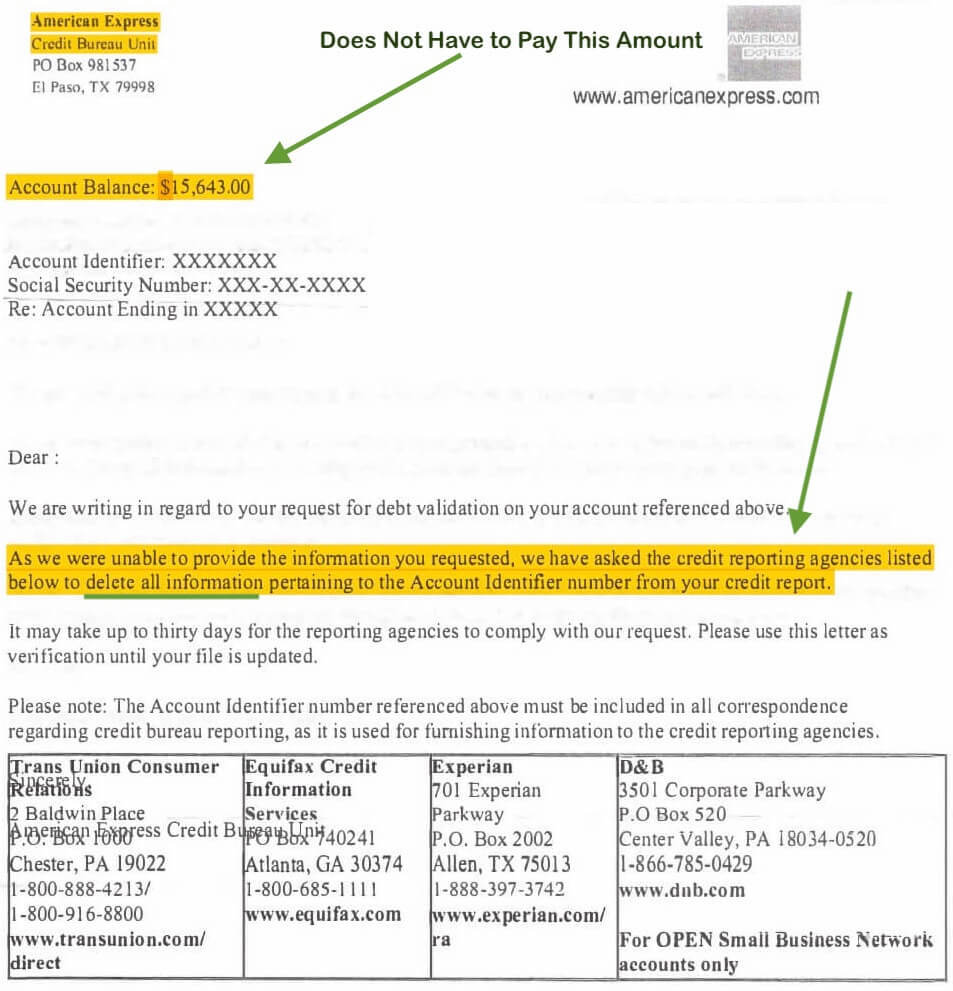

How to settle with american express. American express will not consider a settlement unless your account is past due, and the longer your. This means not only are we going to deal with your creditors, negotiating a settlement that works for you and your budget, but in the event that a creditor threatens a lawsuit, or files one, we can. Use the bank account on file to.

Furthermore, settlements often occur after an. The basic idea is that you use found money to pay down your debt. You’ll need to pay at least the minimum payment due each month.

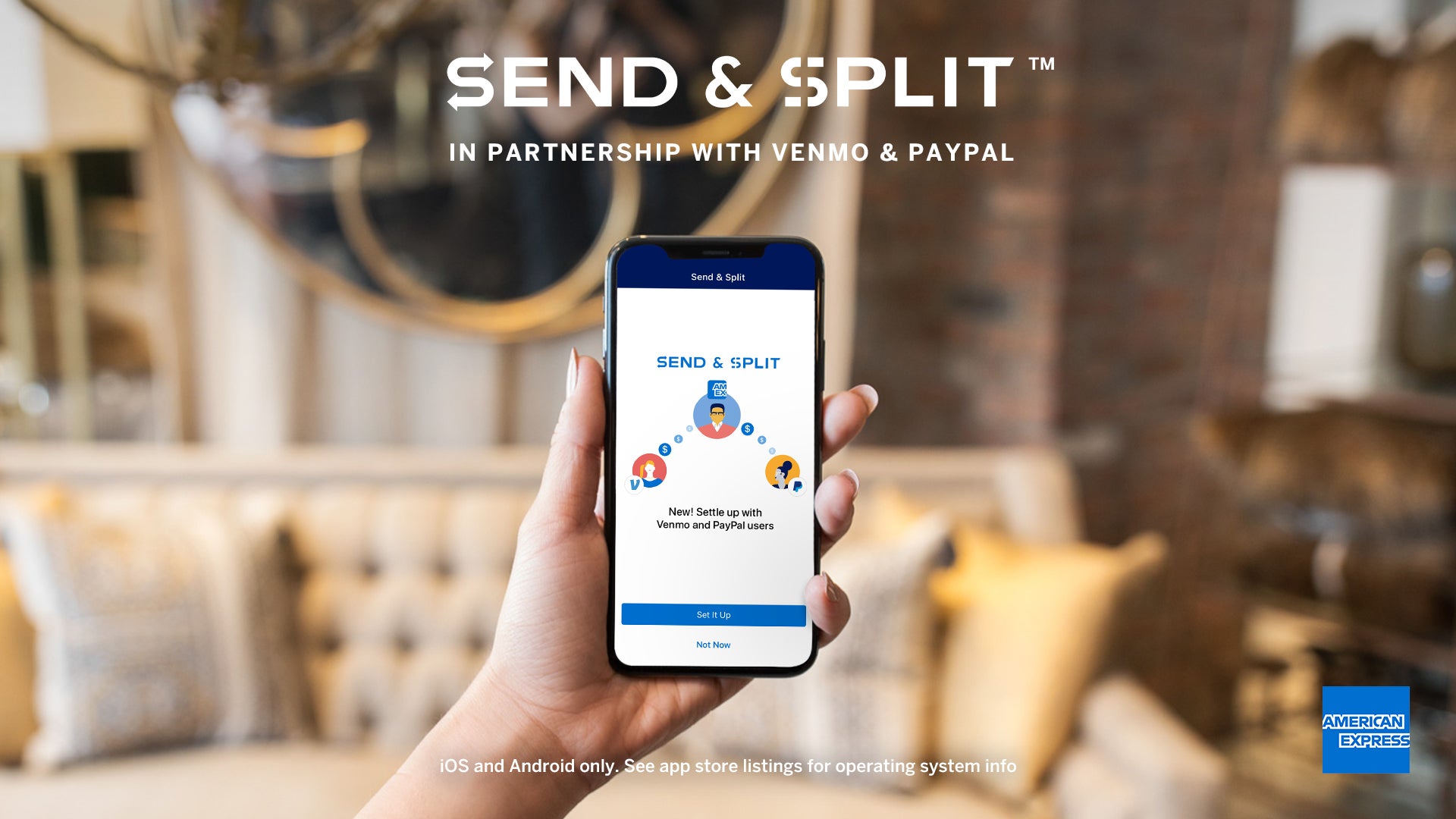

You may also choose to include. We recently learned about business owners that received some pretty. Log in using your online account username and password.

That could be the rainy day change jar you keep in your kitchen, $40 you found in a jacket pocket, or $200 you. If this doesn’t yield results, you could introduce a new policy of adding interest or late fees to overdue invoices. American express transactions will be deposited separately from your visa, mastercard, and discover deposits and are made directly by american express, not by your merchant bank.

Deciding to deal with an american express debt collector is step one. Judgments above $20,001 face value. Payment via axs will be capped at s$3,000 per transaction or your daily.

Pay your american express card bills via axs. Draft your settlement proposal letter. Keep your account safe and secure by customizing your payment and spend alerts.